Truthfully, the best way to get low-cost Dodge Dakota insurance in Henderson is to begin comparing prices regularly from insurance carriers who sell auto insurance in Nevada.

Truthfully, the best way to get low-cost Dodge Dakota insurance in Henderson is to begin comparing prices regularly from insurance carriers who sell auto insurance in Nevada.

Step 1: Try to learn about how auto insurance works and the modifications you can make to prevent high rates. Many things that cause high rates like accidents, careless driving, and bad credit can be eliminated by making minor changes in your lifestyle.

Step 2: Request rate estimates from direct, independent, and exclusive agents. Direct and exclusive agents can provide rates from a single company like GEICO or Farmers Insurance, while independent agencies can provide prices from multiple insurance companies. Compare rates now

Step 3: Compare the price quotes to your existing policy to determine if you can save on Dakota insurance in Henderson. If you find better rates, make sure there is no lapse in coverage.

Step 4: Provide proper notification to your current company to cancel your current policy and submit payment and a completed application for the new coverage. As soon as coverage is bound, place the new proof of insurance certificate above your visor, in the console, or in the glove compartment.

One bit of advice is to make sure you’re comparing the same level of coverage on each quote request and and to get prices from all possible companies. Doing this guarantees an accurate price comparison and a complete rate analysis.

Anyone knows that auto insurance companies want to keep you from shopping around. Consumers who shop around for the cheapest rate are inclined to switch companies because of the good chance of finding better rates. A study showed that drivers who compared rates once a year saved approximately $3,450 over four years compared to drivers who never shopped around for cheaper prices.

If finding budget-friendly rates on auto insurance in Henderson is the reason you’re here, then understanding the best way to compare auto insurance can help simplify the process.

Finding the cheapest coverage in Henderson is quite easy if you know the best way to do it. Practically each driver who requires lower cost auto insurance will be able to find lower rates. Nevertheless, Nevada vehicle owners can benefit by having an understanding of how the larger insurance companies sell online and take advantage of how the system works.

The best way we recommend to compare insurance rates in your area utilizes the fact all the major auto insurance companies provide online access to compare their rates. The one thing you need to do is give them rating details including if a SR-22 is needed, how your vehicles are used, which vehicles you own, and your education level. Your information gets transmitted to many different companies and you should receive rate quotes within a short period of time.

If you would like to compare rates now, click here and find out if lower rates are available in Henderson.

The providers in the list below have been selected to offer quotes in Henderson, NV. If your goal is to find cheap auto insurance in Nevada, it’s a good idea that you get rate quotes from several of them to get a more complete price comparison.

Insurance does more than just repair your car

Despite the fact that insurance is not cheap in Henderson, insurance may be required for several reasons.

- Just about all states have minimum liability requirements which means you are required to carry a specific minimum amount of liability insurance coverage if you want to drive legally. In Nevada these limits are 15/30/10 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you have a lien on your vehicle, most lenders will require that you have insurance to ensure they get paid if you total the vehicle. If you let the policy lapse, the lender will be forced to insure your Dodge for a lot more money and make you pay much more than you were paying before.

- Insurance protects both your car and your assets. It will also cover medical expenses that are the result of an accident. One of the most valuable coverages, liability insurance, will also pay to defend you in the event you are sued. If you have damage to your Dodge as the result of the weather or an accident, comprehensive and/or collision insurance will pay to restore your vehicle to like-new condition.

The benefits of carrying adequate insurance definitely exceed the price paid, particularly for liability claims. Despite what companies tell you, the average driver is overpaying more than $855 a year so compare rates each time the policy renews to be sure current rates are still competitive.

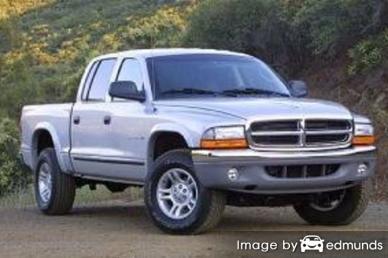

Dodge Dakota insurance rate analysis

The rate information displayed below highlights estimates of prices for Dodge Dakota models. Understanding more about how insurance policy premiums are formulated can be useful when making smart choices when choosing a car insurance company.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Dakota ST Ext Cab 2WD | $210 | $440 | $396 | $24 | $118 | $1,188 | $99 |

| Dakota Bighorn Ext Cab 2WD | $210 | $440 | $396 | $24 | $118 | $1,188 | $99 |

| Dakota Lonestar Ext Cab 2WD | $242 | $440 | $396 | $24 | $118 | $1,220 | $102 |

| Dakota ST Crew Cab 2WD | $242 | $440 | $396 | $24 | $118 | $1,220 | $102 |

| Dakota Bighorn Crew Cab 2WD | $242 | $520 | $396 | $24 | $118 | $1,300 | $108 |

| Dakota Lonestar Crew Cab 2WD | $242 | $520 | $396 | $24 | $118 | $1,300 | $108 |

| Dakota Bighorn Ext Cab 4WD | $272 | $440 | $318 | $18 | $96 | $1,144 | $95 |

| Dakota ST Ext Cab 4WD | $272 | $440 | $318 | $18 | $96 | $1,144 | $95 |

| Dakota Laramie Crew Cab 2WD | $272 | $520 | $396 | $24 | $118 | $1,330 | $111 |

| Dakota ST Crew Cab 4WD | $272 | $440 | $318 | $18 | $96 | $1,144 | $95 |

| Dakota Lonestar Ext Cab 4WD | $272 | $440 | $318 | $18 | $96 | $1,144 | $95 |

| Dakota Bighorn Crew Cab 4WD | $272 | $440 | $318 | $18 | $96 | $1,144 | $95 |

| Dakota TRX Crew Cab 4WD | $272 | $520 | $318 | $18 | $96 | $1,224 | $102 |

| Dakota TRX Crew Cab 4WD | $272 | $520 | $318 | $18 | $96 | $1,224 | $102 |

| Dakota Lonestar Crew Cab 4WD | $272 | $520 | $318 | $18 | $96 | $1,224 | $102 |

| Dakota Laramie Crew Cab 4WD | $304 | $520 | $318 | $18 | $96 | $1,256 | $105 |

| Get Your Own Custom Quote Go | |||||||

Data variables include married male driver age 40, no speeding tickets, no at-fault accidents, $100 deductibles, and Nevada minimum liability limits. Discounts applied include safe-driver, multi-vehicle, claim-free, multi-policy, and homeowner. Price information does not factor in Henderson location which can alter rates significantly.

The chart below demonstrates how choosing different deductibles and can increase or decrease Dodge Dakota yearly insurance costs for each age group. The rate quotes are based on a married female driver, comp and collision included, and no policy discounts are applied.

Do you qualify for discounts?

Car insurance is easily one of your largest bills, but there are discounts available to reduce the price significantly. A few discounts will automatically apply at the time of purchase, but less common discounts must be specially asked for in order for you to get them.

- Air Bag Discount – Factory options such as air bags or motorized seat belts could see savings of 20 to 30 percent.

- Organization Discounts – Being a member of qualifying clubs or civic groups could earn you a nice discount on car insurance.

- Low Mileage Discounts – Maintaining low annual mileage can qualify you for lower car insurance rates on the low mileage vehicles.

- Pay Early and Save – If paying your policy premium upfront rather than paying in monthly installments you can avoid monthly service charges.

- Anti-lock Brake System – Cars, trucks, and SUVs with ABS braking systems or traction control prevent accidents and will save you 10% or more on Dakota insurance in Henderson.

- Seat Belt Usage – Forcing all vehicle occupants to buckle their seat belts could cut 10% or more on the premium charged for medical payments and/or PIP.

- Senior Citizens – Drivers that qualify as senior citizens are able to get a small discount on rates.

- Accident Forgiveness – This one is not really a discount per se, but some insurance companies may permit one accident before raising your premiums if your claims history is clear prior to being involved in the accident.

- No Accidents – Drivers who don’t have accidents have much lower rates as opposed to frequent claim filers.

- Discount for Life Insurance – Some car insurance companies give better prices if you take out auto and life insurance together.

Remember that some of the credits will not apply to the entire cost. Most only reduce the price of certain insurance coverages like comp or med pay. So when the math indicates it’s possible to get free car insurance, car insurance companies aren’t that generous.

The illustration below visualizes the comparison of Dodge Dakota yearly insurance costs with and without discounts applied to the premium. The rates are based on a female driver, no accidents, no driving violations, Nevada state minimum liability limits, comp and collision included, and $100 deductibles. The first bar for each age group shows premium with no discounts. The second shows the rates with multi-car, safe-driver, multi-policy, homeowner, claim-free, and marriage discounts applied.

Popular car insurance companies and the discounts they provide are outlined below.

- Progressive may offer discounts for continuous coverage, multi-vehicle, homeowner, multi-policy, and good student.

- Farmers Insurance includes discounts for early shopping, pay in full, business and professional, alternative fuel, youthful driver, multi-car, and bundle discounts.

- Farm Bureau may include discounts for multi-policy, driver training, good student, multi-vehicle, 55 and retired, and youthful driver.

- State Farm has discounts for defensive driving training, anti-theft, good driver, accident-free, and safe vehicle.

- GEICO discounts include five-year accident-free, military active duty, emergency military deployment, seat belt use, and multi-policy.

- SAFECO offers premium reductions for anti-theft, multi-car, anti-lock brakes, accident prevention training, teen safety rewards, and teen safe driver.

- Liberty Mutual offers discounts including preferred payment discount, teen driver discount, safety features, multi-policy, multi-car, and exclusive group savings.

When getting free Henderson car insurance quotes, it’s a good idea to every insurance company which credits you are entitled to. Some credits might not be offered on policies in Henderson. To see a list of car insurance companies that offer the discounts shown above in Nevada, click here.