How many times have you told yourself it’s time to shop around for more affordable Dodge Magnum insurance in Henderson? Finding the cheapest insurance for a Dodge Magnum in Nevada can normally be a painful process, but you can learn a few tricks to find lower rates.

How many times have you told yourself it’s time to shop around for more affordable Dodge Magnum insurance in Henderson? Finding the cheapest insurance for a Dodge Magnum in Nevada can normally be a painful process, but you can learn a few tricks to find lower rates.

There are both good and bad ways to shop for insurance and we’ll show you the best way to price shop coverage for a new or used Dodge and obtain the lowest possible price either online or from Henderson insurance agents.

You should take the time to shop coverage around occasionally because prices fluctuate regularly. Despite the fact that you may have had the lowest quotes on Dodge Magnum insurance in Henderson a few years ago you may be paying too much now. You can find a lot of misleading information regarding Magnum insurance out there, but we’re going to give you some of the best ways to reduce your insurance bill.

If you are insured now or are shopping for new coverage, follow these tips to find better prices without sacrificing coverage. Finding quotes for affordable protection in Henderson is quite easy. Comparison shoppers just have to use the most efficient way to compare prices from many companies at once.

How to get Henderson Dodge Magnum insurance quotes

The companies shown below provide free quotes in Nevada. If you want to find the best car insurance in Henderson, we suggest you visit two to three different companies to get the cheapest price.

Discounts can help to save on Dodge Magnum insurance in Henderson

Properly insuring your vehicles can get expensive, but you might already qualify for some discounts that you may not even know about. Certain reductions will be credited when you quote, but less common discounts must be requested specifically prior to receiving the credit.

- Multi-line Discount – Some car insurance companies give better car insurance rates if you take out life insurance.

- Switch and Save Discount – Some larger companies reward drivers for switching policies before your current expiration date. It could save around 10% when you buy Henderson car insurance online.

- E-sign Discounts – Many car insurance companies will give you a small discount for buying your policy on the web.

- Resident Student – Any of your kids who are attending college and do not have access to a covered vehicle can be insured at a reduced rate.

- Professional Organizations – Being in a civic or occupational organization in Henderson can get you a small discount on your next car insurance statement.

- Student Driver Training – Have your child successfully complete driver’s ed class as it can save substantially.

- ABS and Traction Control Discounts – Cars that have steering control and anti-lock brakes can avoid accidents and the ABS can save up to 10%.

- Accident-Free Discounts – Drivers who don’t have accidents can earn big discounts in comparison with drivers who are more careless.

Don’t be surprised that most discount credits are not given to the entire policy premium. Most cut specific coverage prices like medical payments or collision. Even though it may seem like it’s possible to get free car insurance, it just doesn’t work that way.

To choose car insurance companies who offer car insurance discounts in Nevada, follow this link.

Why Your Insurance Rates might be higher

Many factors are taken into consideration when you get a price on insurance. Some of the criteria are obvious like your driving record, but some are not as apparent such as whether you are married or how safe your car is. One of the most helpful ways to save on auto insurance is to to have a grasp of the different types of things that help calculate your policy premiums. If you have some idea of what impacts premium levels, this enables you to make decisions that may reward you with lower rates.

Shown below are most of the major factors utilized by car insurance companies to help set your rate level.

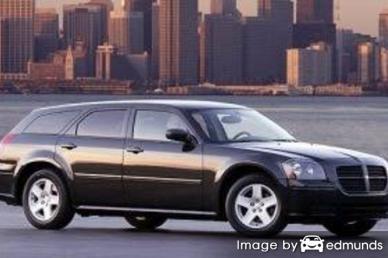

What type of vehicle do you drive? – The make and model of the car you drive makes a huge difference in the rate you pay. The best insurance prices are generally reserved for lower cost passenger cars, but your final cost has many other factors.

Eliminate unneeded add-on coverages – Policies have extra coverages that may not really be needed on your Magnum policy. Things like rental car coverage, high-cost glass coverage, and Farm Bureau memberships could be just wasting money. The coverages may be enticing when discussing your needs, but your money might be better spent on other coverage so consider taking them off your policy.

A good credit score can save money – Credit score is a big factor in determining premium rates. Insureds that have excellent credit tend to be less risk to insure than those with worse credit. If your credit rating is low, you could be paying less to insure your Dodge Magnum if you improve your credit rating.

Prevent auto insurance lapses – Allowing your coverage to lapse is a fast way to increase your auto insurance rates. Not only will rates go up, not being able to provide proof of insurance may result in a license revocation or jail time. You may then be required to file a SR-22 with the Nevada motor vehicle department to get your license reinstated.